What Is Short Term Basis Reported To Irs .check only one box on each part i. Fidelity is now required to report the following to the irs when a covered security is sold:

from www.chegg.com

Fidelity is now required to report the following to the irs when a covered security is sold: in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or.as part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost.

Solved Required information [The following information

What Is Short Term Basis Reported To Irs Fidelity is now required to report the following to the irs when a covered security is sold:check only one box on each part i.as part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. Fidelity is now required to report the following to the irs when a covered security is sold:

From www.chegg.com

Solved Required information [The following information What Is Short Term Basis Reported To Irs Fidelity is now required to report the following to the irs when a covered security is sold: in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or. There are three boxes used to denote whether the transaction was reported to the irs and how you. Either will show whether your. What Is Short Term Basis Reported To Irs.

From www.chegg.com

Solved Problem 43 What is a Capital Asset?, Holding Period, What Is Short Term Basis Reported To Irs in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or.as part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. Fidelity is now required to report the following to the irs when a covered security is sold: Either will. What Is Short Term Basis Reported To Irs.

From slideplayer.com

Senior Married Couple Michael Davenport ppt download What Is Short Term Basis Reported To Irs Either will show whether your basis (usually your cost) was reported to. There are three boxes used to denote whether the transaction was reported to the irs and how you.as part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. in tax year 2011, new legislation was passed. What Is Short Term Basis Reported To Irs.

From studyingworksheets.com

1099 B Worksheet Studying Worksheets What Is Short Term Basis Reported To Irs There are three boxes used to denote whether the transaction was reported to the irs and how you. Fidelity is now required to report the following to the irs when a covered security is sold: in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or. Either will show whether your. What Is Short Term Basis Reported To Irs.

From coinledger.io

How to Fill Out Form 8949 for Cryptocurrency CoinLedger What Is Short Term Basis Reported To Irs There are three boxes used to denote whether the transaction was reported to the irs and how you.as part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or. Either. What Is Short Term Basis Reported To Irs.

From www.chegg.com

Solved Complete Form 941 for the 2nd quarter of 2019 for What Is Short Term Basis Reported To Irs Fidelity is now required to report the following to the irs when a covered security is sold: Either will show whether your basis (usually your cost) was reported to.as part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost.check only one box on each part i. There. What Is Short Term Basis Reported To Irs.

From www.bankrate.com

Schedule D How To Report Your Capital Gains (Or Losses) To The IRS What Is Short Term Basis Reported To Irscheck only one box on each part i. Fidelity is now required to report the following to the irs when a covered security is sold: There are three boxes used to denote whether the transaction was reported to the irs and how you.as part of the energy improvement and extension act of 2008, mutual fund companies are. What Is Short Term Basis Reported To Irs.

From www.reddit.com

Trying to figure out "Was the basis reported to the IRS on your summary What Is Short Term Basis Reported To Irsas part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. Either will show whether your basis (usually your cost) was reported to. There are three boxes used to denote whether the transaction was reported to the irs and how you.check only one box on each part i.. What Is Short Term Basis Reported To Irs.

From www.chegg.com

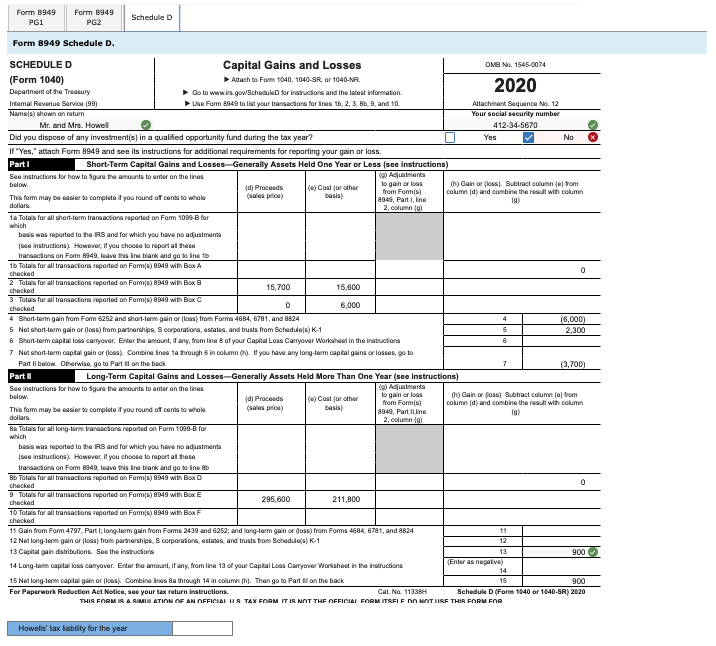

Solved a) Use Form 8949 and page 1 of Schedule D to What Is Short Term Basis Reported To Irs Either will show whether your basis (usually your cost) was reported to.as part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. Fidelity is now required to report the following to the irs when a covered security is sold:check only one box on each part i. Web. What Is Short Term Basis Reported To Irs.

From www.gainskeeperpro.com

In the following Form 8949 example,the highlighted section below shows What Is Short Term Basis Reported To Irsas part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost.check only one box on each part i. in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or. Either will show whether your basis (usually your cost) was. What Is Short Term Basis Reported To Irs.

From sarahjessannmckinley.blogspot.com

Irs 1040 Form Line 8B / Irs Form 1040 Line 8b Fill Online Printable What Is Short Term Basis Reported To Irs Fidelity is now required to report the following to the irs when a covered security is sold:as part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost.check only one box on each part i. There are three boxes used to denote whether the transaction was reported to. What Is Short Term Basis Reported To Irs.

From proconnect.intuit.com

Attach a summary to the Schedule D and Form 8949 in ProSeries What Is Short Term Basis Reported To Irs in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or. Fidelity is now required to report the following to the irs when a covered security is sold:check only one box on each part i. Either will show whether your basis (usually your cost) was reported to.as. What Is Short Term Basis Reported To Irs.

From heinonline.org

Redirecting... What Is Short Term Basis Reported To Irs Fidelity is now required to report the following to the irs when a covered security is sold:check only one box on each part i. There are three boxes used to denote whether the transaction was reported to the irs and how you.as part of the energy improvement and extension act of 2008, mutual fund companies are. What Is Short Term Basis Reported To Irs.

From www.chegg.com

Solved [The following information applies to the questions What Is Short Term Basis Reported To Irscheck only one box on each part i.as part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or. Fidelity is now required to report the following to the. What Is Short Term Basis Reported To Irs.

From money.stackexchange.com

united states What are the requirements to not report all stock What Is Short Term Basis Reported To Irsas part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. Fidelity is now required to report the following to the irs when a covered security is sold: in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or. There are. What Is Short Term Basis Reported To Irs.

From www.pdffiller.com

2019 Form IRS 8949 Fill Online, Printable, Fillable, Blank pdfFiller What Is Short Term Basis Reported To Irsas part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or. There are three boxes used to denote whether the transaction was reported to the irs and how you. Web. What Is Short Term Basis Reported To Irs.

From invertiralmaximo.com

Anexo D Cómo informar sus ganancias (o pérdidas) de capital al IRS What Is Short Term Basis Reported To Irsas part of the energy improvement and extension act of 2008, mutual fund companies are required to report your cost. Either will show whether your basis (usually your cost) was reported to.check only one box on each part i. in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any. What Is Short Term Basis Reported To Irs.

From www.youtube.com

IRS releases draft Form 1065 instructions on partner tax basis capital What Is Short Term Basis Reported To Irs in tax year 2011, new legislation was passed requiring brokers to report adjusted basis and whether any gain or.check only one box on each part i. There are three boxes used to denote whether the transaction was reported to the irs and how you.as part of the energy improvement and extension act of 2008, mutual. What Is Short Term Basis Reported To Irs.